SHARETIPSINFO >> Articles Directory >> RECESSION, Is it an opportunity to build your fortune in stock market?

RECESSION:

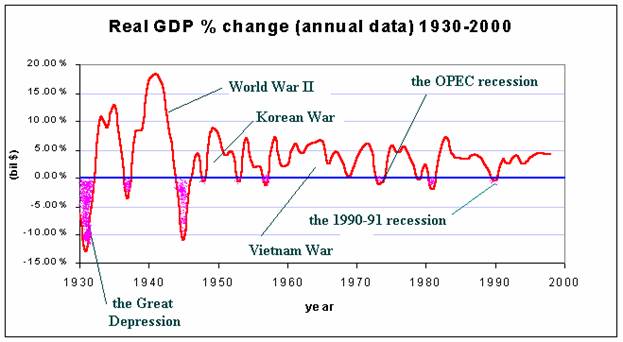

Economic activity usually passes through four phases –recession, depression, recovery and boom. When GNP and the employment are declining, the economy is said to be in a recession, which, when deep becomes a depression. When output and employment are rising, the economy is said to be in a phase of recovery, which becomes boom as full employment nears and industries operate at maximum capacity.

A recession usually last for one to three years during which the rate of unemployment while rising is generally below 12 percent. When a recession lasts for more than three years and /or the rate of unemployment lies between lies above 12 percent and 20 percent, the economy may be said to be suffering from a depression. When unemployment remains high and business stagnates for six or more years, the nation is said to be experiencing the great depression.

Capitalist system follows historical determinism ie; a certain predictable pattern.

In US economy that is predominantly capitalist economy there has been at least one recession every decade, and a great depression every third or sixth decade. If the third decade manages to avoid a depression, then the sixth decade experiences the cumulative effect.

The Great depression of 1780: After the British defeat at Yorktown in October 1781,a downturn set in. Business activity started declining in 1782.The economy went into depression, which was due to huge deficit in the balance of trade. US economy was flooded by European goods which destroyed the American industry. However US economy finally came out of depression in 1787.

The Great depression of 1840: In between 1790 and 1820 there were many downturn but all were recession because none of the downturn was more than 3 years. According to our historical determinism, capitalist economy faces depression every three decade or if it happens to bypass it sixth decade sees more deep recession. That is what happened in 1840.US economy slipped into great depression that too lasted for seven years from 1840 to 1846.This contraction in the business activity is called the Debt Repudiation Depression. The business activity fell by more than 20%.

The Great depression of 1870: This contraction started in 1873 and lasted till 1879.

The Great depression of 1930: Economy did not experience any depression in 1910.The year of 1930 started with the crashing of the stock market, failure of several banks. The depression lasted almost for ten years. When fresh life was injected in the economy in the form of Second World War.

There is no such Great depression since 1930s though there is minor recession which lasted for maximum 2 years.

SOME OF THE RECESSION:

Contraction in the economic activity for less than 3 years period.

1945

1960

1970

January-July 1980

July 1981-november 1982

July 1990-march 1991.

November2001-November 2002

MARX VIEW ON THE ECONOMIC CONTRACTION (RECESSION, WHEN PROLONGED DEPRESSION)

Marx used ‘crisis’ to indicate the periodic occurrence of situation within capitalism, where the process of renewal and expansion of capital would be interrupted. This periodic breakdown occurs because of the continual urge towards accumulation and investment of capital outruns the condition that ensures profitability.

Realization problem:

The core of this crisis according to Marx, lies in the specific nature of capitalist production i.e.; in the fact that capitalist production is not only for sale in the market ,but here the whole production process is just a phase within the K(capital)-circuit(M-C-M`),inclusive of production process becomes

Source :sharetipsinfo

Thus within capitalism, money is firstly converted into means of production and labor (M-C). Then production is converted into `P` takes place. After this produced quantity C` have to be sold at the exchange value M. When this whole circle gets completed we say that the produced commodities C` get realized.

For this to happen there must exist sufficient monetary demand (i.e.; purchasing power) in the economy. If there is any lack of such monetary demand, we say realization problem has set in and then the completion of K-circuit (M-C-M`) gets aborted and capitalism faces its crisis.

In capitalist society production is done for profit motive. So, due to continuous accumulation of capital gets by productive activity capital gets concentrated to few individuals. The lack capital among the most of the public decreases the demand and hence realization problem creeps in. The price starts decreasing, investment goes down and unemployment increases. Whole economy goes into a downward spiral.

If adequate timely measure to prop up demand is not taken through the fiscal and monetary stimulus, it could end up in painful depression.

WHY IT IS DIFFICULT FOR GOVERNMENT TO AVERT RECESSION:

In capitalist economy money is the main driver of economy activity.

M-Money supply

V-Velocity of money (speed with which money changes hand)

P- Price of the output.

Y- Real output.

In order to increase the output in the economy various measures are taken fiscal as well as monetary. These measures increase the money supply in the economy. With the increase in the money supply after some time lag velocity of the money also increases. Now to balance the above equation, real output(Y) in the economy increases.

Source :sharetipsinfo

After certain point of time real output cannot increase because of technology constraint as well as the constraint posed by the resources at the disposals. In the second phase real output remains stagnant and the Price (P) starts increasing this is the onset of rapid increase in inflation. Increase in inflation without any increase in employment is also called as stagflation. Now the main objective of the government shifts from growth towards inflation. Containing inflation becomes the major objective.

Source :sharetipsinfo

At this juncture various monetary benefits are withdrawn; interest rate increases and tax rates are increased in order to contain the inflation. These measures bear fruit as demand recedes but the economy pays price in the form of recession in the economy. The economy goes into recession. If government does not intervene at this stage with proper dose to stimulate demand, the recession will take the shape of depression or crisis.

HOW MONEY GROWTH AND INFLATION MOVE ARE IN TANDEM:

Chart below shows the long-run cycles of inflation and money growth per decade(1750-1970).except for the aftermath of the civil war of the 1860,the money growth rate per decade reached its peak every third decade over more than two centuries, and so did the rate of inflation.

Source : sharetipsinfo

WEALTH CONCENTRATION IN US:

Source:sharetipsinfo

YEAR |

SHARE OF WEALTH BY1%OF US ADULTS |

1JAN1810 |

21 |

|

|

|

1JAN1860 |

24 |

|

|

|

1JAN1870 |

27 |

|

|

|

1-Jan-00 |

31 |

|

|

|

1-Jan-22 |

31.6 |

|

|

|

1-Jan-29 |

36.3 |

|

|

|

1-Jan-33 |

28.3 |

|

|

|

1-Jan-39 |

30.6 |

|

|

|

1-Jan-45 |

23.3 |

|

|

|

1-Jan-49 |

20.8 |

|

|

|

1-Jan-53 |

27.5 |

|

|

|

1-Jan-56 |

26 |

|

|

|

1-Jan-58 |

26.9 |

|

|

|

1-Jan-62 |

27.4 |

|

|

|

1-Jan-63 |

31.6 |

|

|

|

1-Jan-65 |

29.2 |

|

|

|

1-Jan-69 |

24.9 |

|

|

|

1-Jan-83 |

34.3 |

|

|

|

Whenever concentration of wealth happened in the economy, economy faced risk of contraction. This is the extreme way of the market to redistribute the wealth. When wealth becomes concentrated, three affects normally occurs. First, the number of persons with few or no assets rises. As a result the demand for loan increases, because the borrowing needs of the poor and middle-income groups far exceeds the affluent. Second, since the poor and the middle class, who are in majority, now have fewer assets, the borrower in general becomes less credit-worthy than before. If bank rejects the risky borrowers, its financial structure remains sound. But in an environment where credit worthiness has generally deteriorated, most banks cannot afford to be choosy, especially when they have to pay interest. Thus as the concentration of wealth rises, the number of banks with relatively shaky loans also rises. And the higher the concentration, the greater the number of potential bank failure.

A side effect of the growing wealth disparity is the rise in speculative investment. As a person becomes wealthy, his risk taking capacity increases. It essentially reflects human urge to make quick profit. It means margin or installment buying of asset and goods only for resale and not for productive purposes. When others see the rich profiting quickly from the speculative purchases, they tend to follow.

As Kindle Berger points out, speculative fever tends to feed on itself, and by the time the general population rushes to join the bandwagon, the venture is usually nearing its last stage.

HOW TO PROFIT FROM RECESSION:

Look for the above indicators money growth, inflation and concentration of wealth in the economy. This will appropriately tell you about peak. After going through this article you will be well conversant with the economic cycle. You will be at ease in predicting the economies movement. Capitalist economy shows pattern that is rhythmic in nature. One can in advance start preparing for the recessionary phase.

Some of the steps that can be taken before the start of the recession are:

Sell your risky portfolio like real asset, equity portfolio and move into more secure investment like government bond.

Start making provisioning for the slack season. One should save ample to survive the downturn in advance.

Start cutting the unnecessary expenses.

When you are in recession, it is ideal time open yourself a bit.

This is ideal time to acquire wealth as everything is at dearth cheap price.

Keep on buying real estate, equity systematically.

Don’t buy at one go. Buy in small numbers.

Remember sectors that were fancy in the last boom will not be fancy in the next boom, so look for the upcoming sectors. Look around yourself, you will get one.

Make your portfolio diversify. Because at this time one don`t which company or sector will come out victorious.

Think out of box to beat recession.

This is the time for investor to flock the street in order to make very good portfolio.

Be aggressive in investment rather the defensive.

CONCLUSION:

This is the phase when capital is reorganizing itself for next boom. It is also the time when one should go in for introspection. One should take into account what is good and what is bad. Recession is natural process of penalizing the industry that is worthless for the society. Only the best and the thing that is of use for the economy survives the downturn.

That’s why we always ask our investor to invest in the company that is at the core of economic activity rather than at the periphery of the economic activity.

Make this recession as an opportunity to build your fortune.

We expect this article will in small way help our readers in taking the right view on the economic condition.

For more articles click here

To Know About our Packages Click here

Click here for Indian stock market tips