http://sharetipsinfo.comJust get registered at Sharetipsinfo and earn positive returns

Sumitosh Naskar is a farmer from West Bengal who has been making use of the Pradhan Mantri Fasal Bima Yojana (PMFBY) for the past two years. When he faced losses of Rs 200,000 during Kharif 2017, he was hoping the claim would be credited in a few weeks, but it took almost four months.

“I am happy that such a scheme exists but it is a reality that there are claim delays. As farmers when we enquire about the claims, there is a blame-game that continues between the government agencies and the insurers,” he said.

Naskar may not be among the farmers below the poverty line but he added that there have been several of his counterparts in the village whose sustenance is dependent on crops.

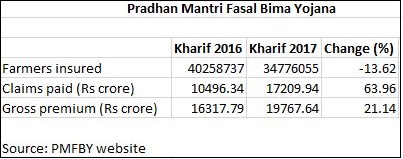

There are hundreds of farmers who have had similar experiences under PMFBY, which has completed three years. Delays in claim settlement in a few cases and requirement of Aadhaar for the joinees has led to a drop a 13.6 percent drop in the number of farmers insured under the scheme.

The scheme

Launched in 2016, PMFBY compensates farmers if any of the notified crops fail due to natural calamities, pests and diseases. The scheme seeks not just to insulate farmers from income shocks, but also encourage them to adopt modern agricultural practices.

Unlike previous schemes, PMFBY is open for both farmers who have taken loans (loanee) as well as those who have not (non-loanee). Naskar, from West Bengal, was a non-loanee.

The scheme covers food crops (cereals, millets and pulses), oilseeds as well as horticultural crops.

Farmers pay 2 percent of sum insured as the premium for Kharif crops while it is 1.5 percent of the sum insured for Rabi crops.

What are the challenges?

Aadhaar has been made mandatory for availing crop insurance from Kharif 2017 season onwards. Therefore, all banks have been asked to mandatorily obtain the Aadhaar number of farmers and the same applies for non-loanee farmers enrolled through banks/Insurance companies/insurance intermediaries.

This, said sources, has led to many farmers not being eligible for the scheme and therefore dropping out of the system.

“There should be a system to accept other proofs like the Kisan Credit Card or ration card for identity purposes under the programme,” said an insurance official specialising in agriculture schemes.

Secondly, there have been delays in the payments of claims. This has dissuaded farmers (non-loanee) from continuing with the scheme.

In an answer to a question posed in the Lok Sabha on claims delays under PMFBY, the agriculture ministry said admissible claims are generally paid by the insurance companies within two months of completion of crop cutting experiments/harvesting period.

This is, however, subject to availability of yield data and total state share of premium subsidy from concerned state government within time.

“Settlement of claims in some states get delayed due to reasons like a delayed transmission of yield data, late release of their share in premium subsidy by some states, yield-related disputes between insurance companies and states,” said the ministry.

They had also said non-receipt of account details of some farmers for transfer of claims and NEFT-related issues are also a factor. This scheme only allows electronic transfer of claims. No cash, cheque payments can be done.

The head of claims at a large private general insurance company added state governments often dispute the payment and delay releasing the subsidies.

“Delay in claims are unavoidable in certain cases because our payments are directly linked to when the government releases the payments,” he added.

Farmers, whose claims have either been delayed or denied, often develop a trust deficit and opt out of the programme. For instance, earlier damage due to wild animal attacks was not covered and claims related to that were rejected. This will now be covered under the new guidelines.

Way forward

The government has revised the operational guidelines of the scheme from the Rabi 2018-19 season onwards. This is aimed at ensuring better transparency, accountability and timely payment of claims to the farmers.

Under the new norms, state governments have to pay 12 percent interest rate for delay in the release of the state's share of subsidy beyond three months of prescribed cut-off date/submission of a request by the insurer. Also, there is a provision of 12 percent interest rate per annum to be paid by the insurance company to farmers for the delay in settlement claims beyond 10 days of the cut-off date.

However, the government has not yet clarified on the facilities for the farmers who are not enrolled under the Aadhaar scheme. Once other modes of identity are allowed under PMFBY, it is anticipated that more numbers will join.