http://sharetipsinfo.comJust get registered at Sharetipsinfo and earn positive returns

Investor sentiment seems to have turned positive again as the Sensex climbed back to mount 40,000 after nearly a five-month break and hit a new record high of 40,345.

Slowdown worries, weak earnings in June quarter, FII selling, NPA concerns among other factors ruined investor confidence and dragged the index to 36,100 levels, on an intraday basis, from the peak of 40,308 on June 3, 2019.

The massive correction got the acknowledgement of the government, which introduced a slew of measure to revive the economy, as well as, earning of the India Inc. In the two months after touching the low of 36,100 levels on August 23, the index gained more than 3,900 points.

The market generally factors in all the positive and negative news sooner rather than later. Hence, one could say that the current rally is on optimism that the economy could recover from the second half of FY20 on the back of a good festive season and in line to better-than-expected earnings in September quarter.

RELATED NEWS

Sensex at record high! Experts remain optimistic as rally has more legs

'Nifty approaching towards 11,980, minor dips could be buying opportunity'

But looking at the stock price data, the "hope rally" was driven only by few stocks and it was not a broad-based run. In fact, the BSE Midcap index fell 3.3 percent and Smallcap index dropped 10 percent in nearly five months.

However, a closer look at the data reveals that this "hope rally" was driven by only a few stocks and was not broad-based. In fact, the BSE Midcap index fell 3.3 percent and Smallcap index dropped 10 percent in nearly five months.

In the five months it took to reclaim Mount 40k, little more than 30 percent stocks in the BSE500 index were in a positive terrain.

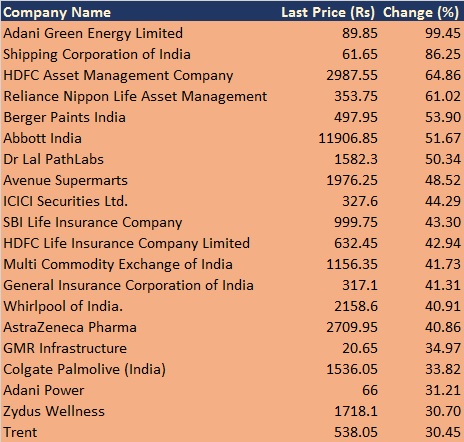

Among those 30 percent, around half of stocks gave double-digit returns, of which, the top 20 stocks rallied between 30 percent and 99 percent.

Adani Green Energy, Shipping Corporation of India, HDFC AMC, Reliance Nippon, Berger Paints, Dr Lal PathLabs, Avenue Supermarts, ICICI Securities, SBI Life, HDFC Life, MCX, GIC Re, Colgate etc were among those 20 stocks.

However, on the other side, more than 200 stocks fell double-digit with top 35 stocks declining over 50 percent which included most of the companies that faced high debt, corporate governance, asset quality concerns etc.

www.sharetipsinfo.com